Control and shape your risk digitization

THE platform

LLM-first, built for control and explainability

The Cytora Platform gives brokers, insurers and reinsurers unprecedented control to digitize the intake they receive from trading partners. Clients can digitize any type of request - from new business to claims - across any line of business, allowing them to control and shape their digitization strategy, as they see fit. With Cytora, clients control the entire process. They can build, test, and launch any line of business, shaping their view of risk – without constraints or dependencies. The Cytora Platform is LLM-first, giving access to the latest advancements in AI, purpose-built for commercial insurance and fully modular.

Author your view of risk

Risk travels unstructured and heterogeneous through the value chain. Cytora lets you author your view of risk across submission, internal and external sources using natural language - no training required and without constraints or dependencies.

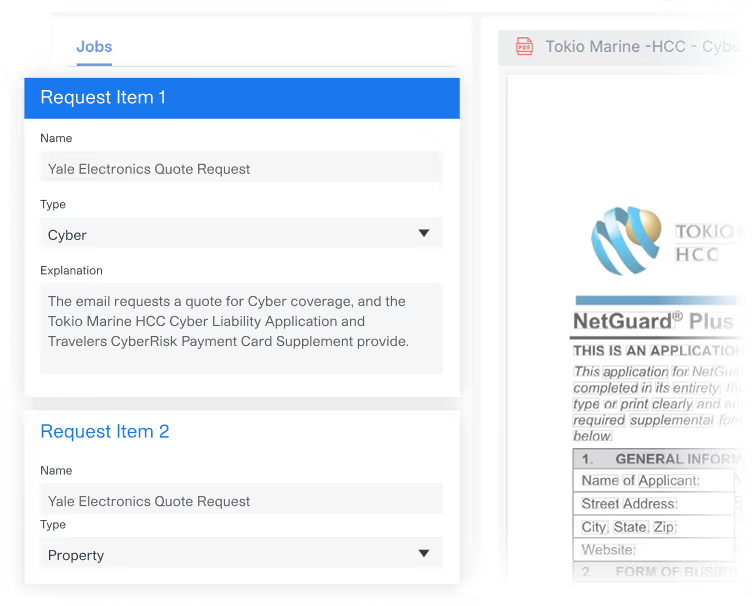

Concierge

Your intake contains a variety of request types. Concierge classifies each request and matches it to the according to the correct schema digitizer.

Digitization center

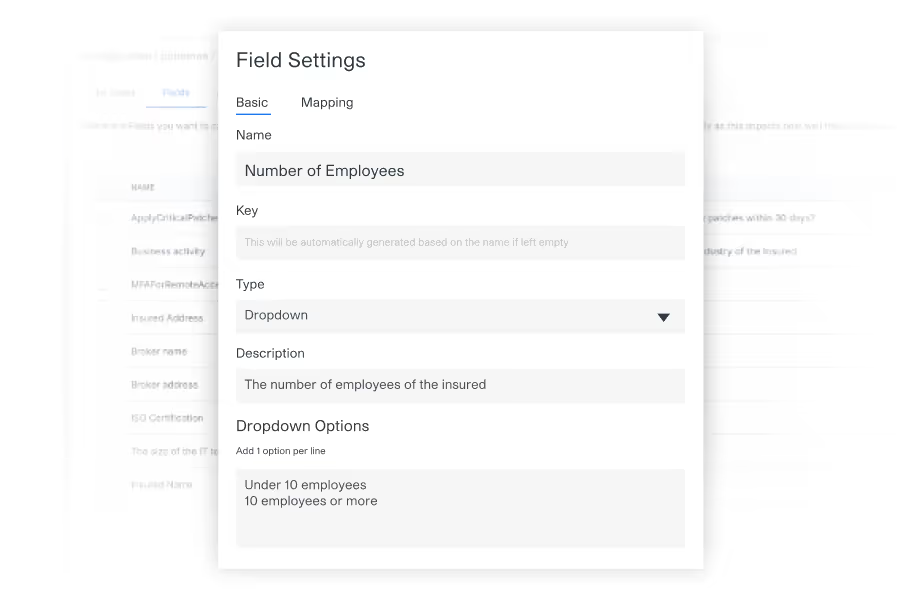

Author your view of risk by adding fields to your schema in natural language - no training required. Fulfil schemas from different digitization actions.

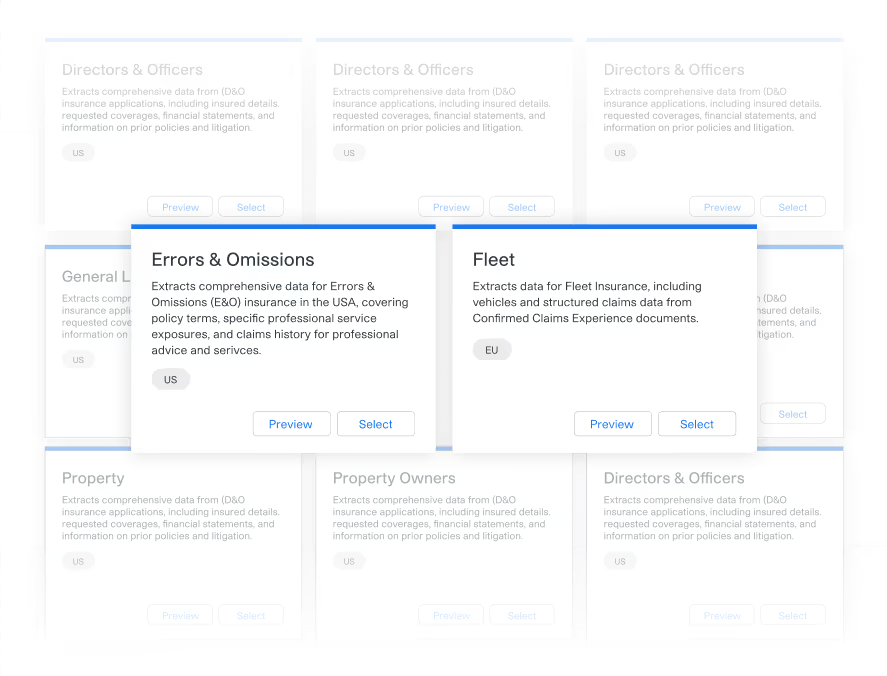

Pre-built schemas

Choose from a library of out-of-the-box schemas to accelerate deployments across all transaction types and lines of business.

Actions

Choose from different digitization actions including extraction, inference, entity resolution, enrichment and evaluation.

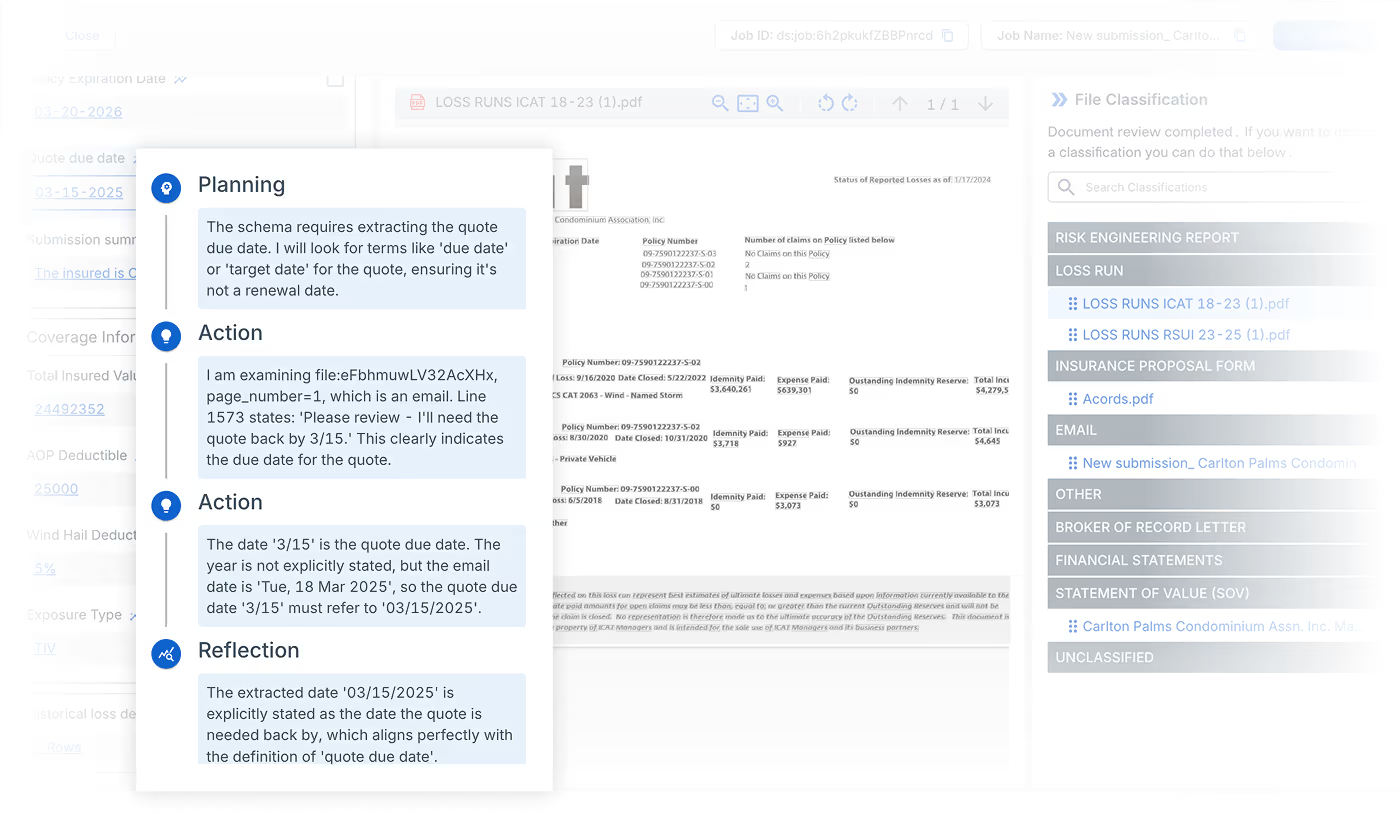

Unified reasoning

Control how schema fields are fulfilled using different modes, including single source, composite across all sources and using one source to verify another.

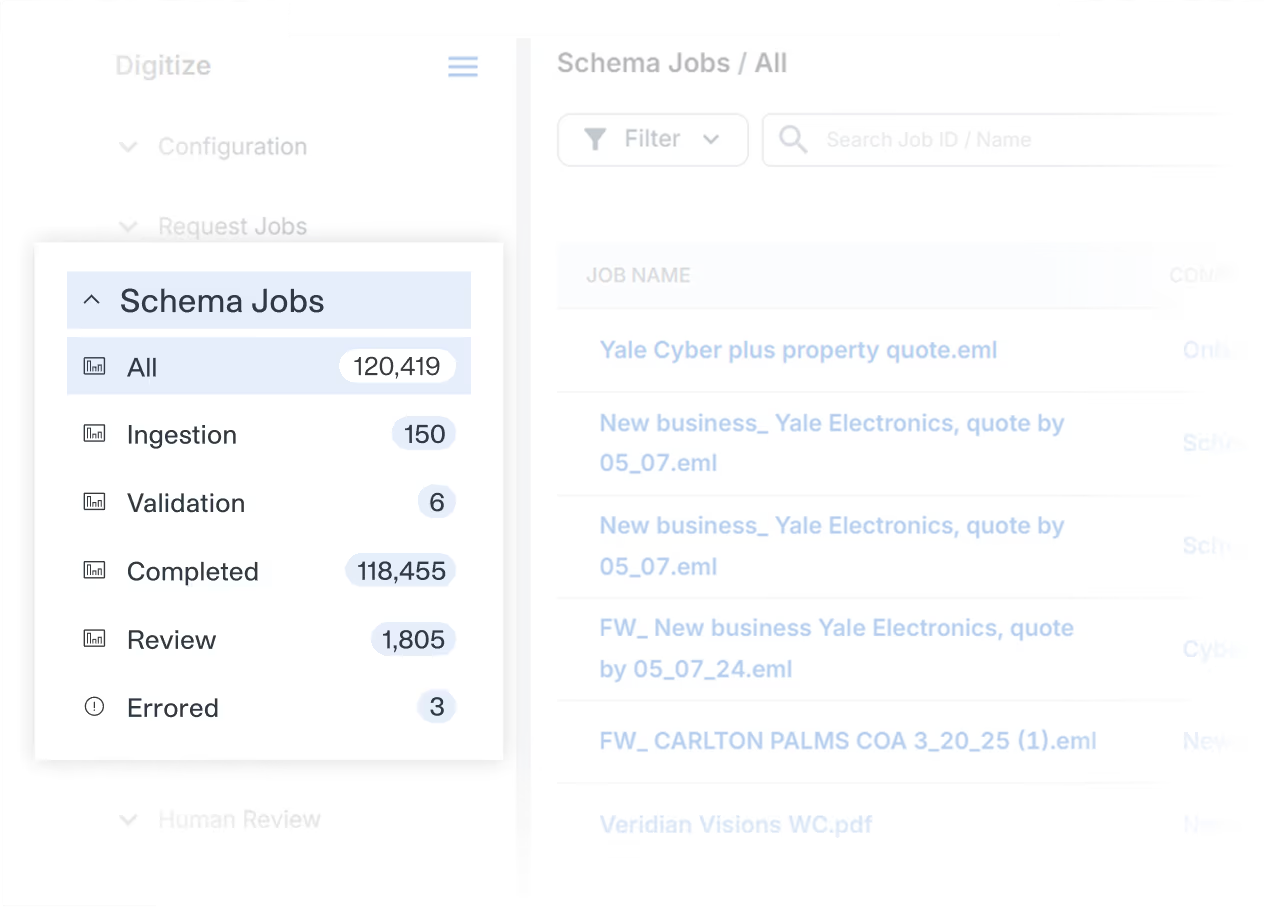

Digitize your intake

Effective workflows move risks for decisioning without absorbing capacity. Cytora digitizes your intake from new business to claims, fulfills your view of risk and turns every transaction you receive, decision-ready.

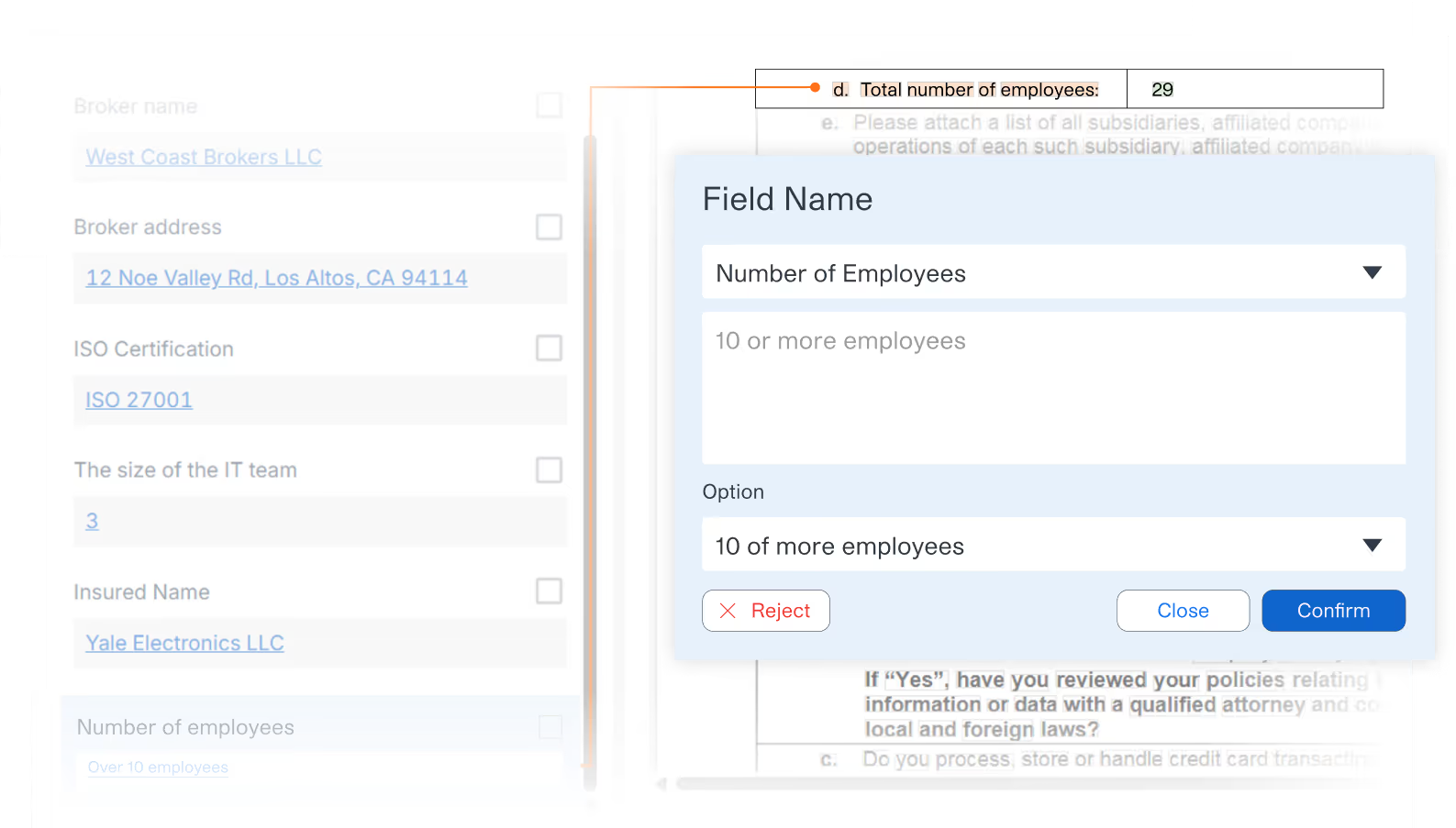

Human review

Configure human review rules based on confidence thresholds to streamline your exception handling workflows.

Routing

Pre-populate downstream systems to accelerate quotes, adjudicate claims, process endorsements and streamline all core workflows .

Optimize your flows

Risk is changing at an accelerating rate requiring management to achieve visibility over workflows. Transparent, traceable and explainable digitization lets you refine decisioning flows, optimize automation and accelerate target portfolio shape.

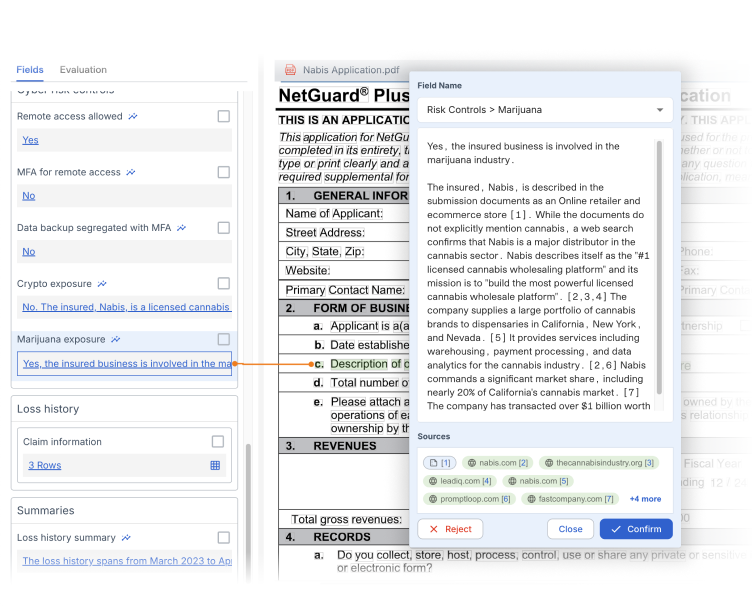

Explainability

Achieve full control and transparency through field-level provenance, chain of throught reasoning and confidence scoring.

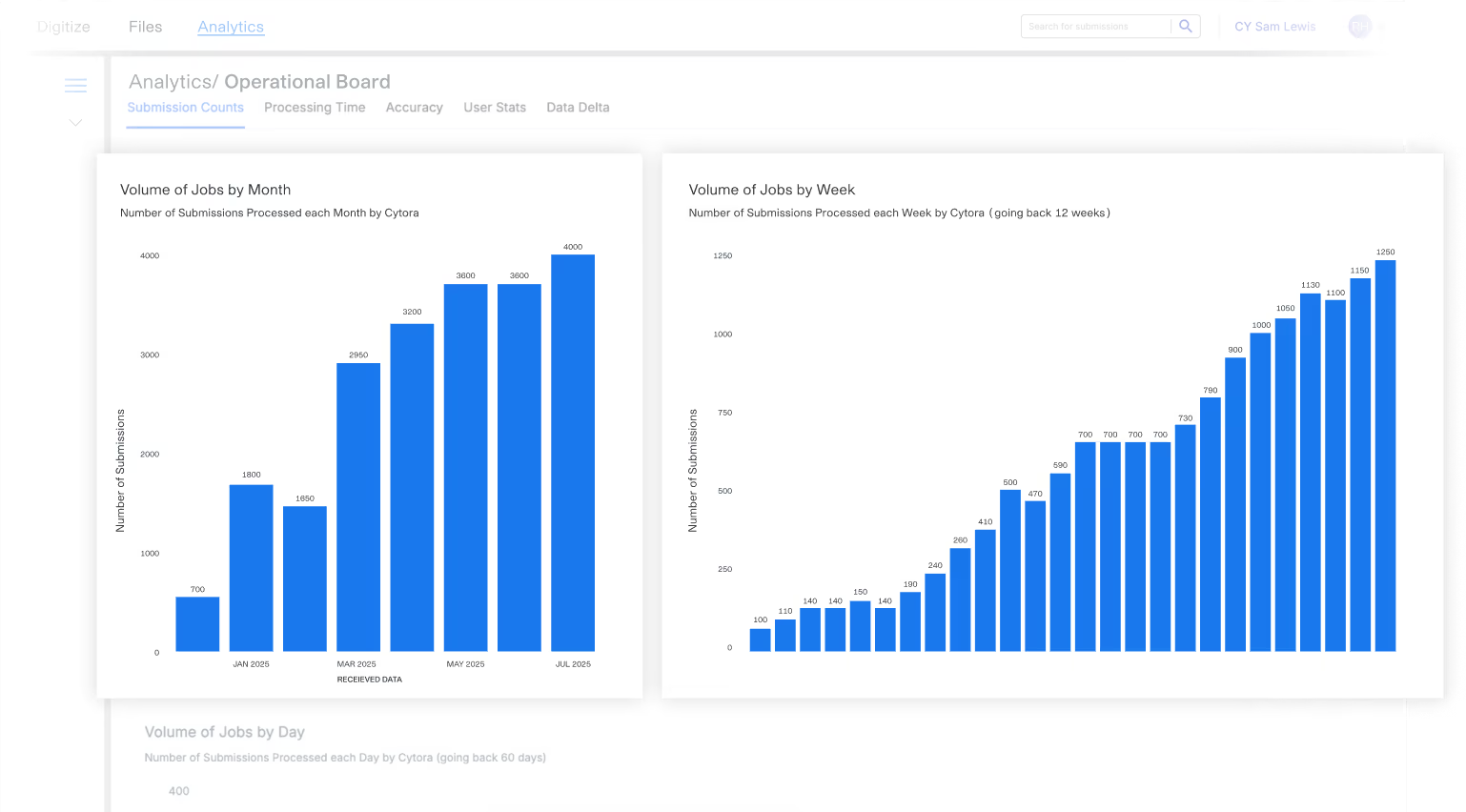

Analytics

Real time visibility across operational metrics helps you accelerate capacity creation, turnaround time and automation objectives.

What our customers say

“

This partnership is part of our strategic investment in digital capabilities to help Arch deliver exceptional underwriting and profitable growth. Cytora will help us streamline key workflows, ensure more consistent execution and deliver a world-class experience to our brokers and clients.”

Head of AI & Automation - North America

Unique advantages

Digitize your intake, the way you want

Take Control

Our clients control their entire risk digitization process. They can build, test, and launch any line of business, shaping their view of risk – without constraints or dependencies.

Time to Value

The Cytora platform is configured in natural language and does not require training, unlocking fast go lives, accelerated benefit realisation and scalable deployments across your intake.

Example Flows

Flexible across your intake

Delivery track record

Proven results at scale

“

We are investing in digital capabilities to unlock scalable growth, Cytora enable us to streamline key workflows enhancing efficiency and effectiveness and further developing how we use data to drive decision making across the group and accelerating our profitable growth.”

“

We now have 38% less people involved in the processing part of it, so they can spend more time on other things, more value adding tasks. So with 38% less people we are handling 38 per cent more cases and in cases per underwriters, that’s an increase of 100%.”

Amir Farid

“

The collaboration is focused on enabling Chubb Claims documents to be automatically digitized, eliminating the need for manual intervention. Cytora’s platform enables Chubb teams to create, compose and deploy AI-native Claims document flows in a scalable approach across multiple markets and lines of business.”

Amir Farid

Deploy your digital risk flows with Cytora